- 1 Minute to read

- Print

- DarkLight

Gift Aid Approval

- 1 Minute to read

- Print

- DarkLight

In order for a persons transactions to appear in a Gift Aid claim, you must record their approval and the dates that the approval is valid for.

There are three ways to achieve this:

1. During Xero contact creation

You can configure infoodle to create infoodle contacts when a new contact comes into infoodle from Xero. At that point you can elect to automatically add the Gift Aid approval, and from what date to start claiming transactions through infoodle. For more information about this, see Xero Contacts.

Usually this date will be the date of the end of the period of your most recent Gift Aid claim filed prior to using infoodle.

2. Manually add an approval

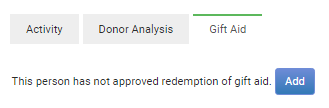

On a persons profile there will be a finance tab. On that tab is a 'Gift Aid' sub-tab. There is an 'Add' button here.

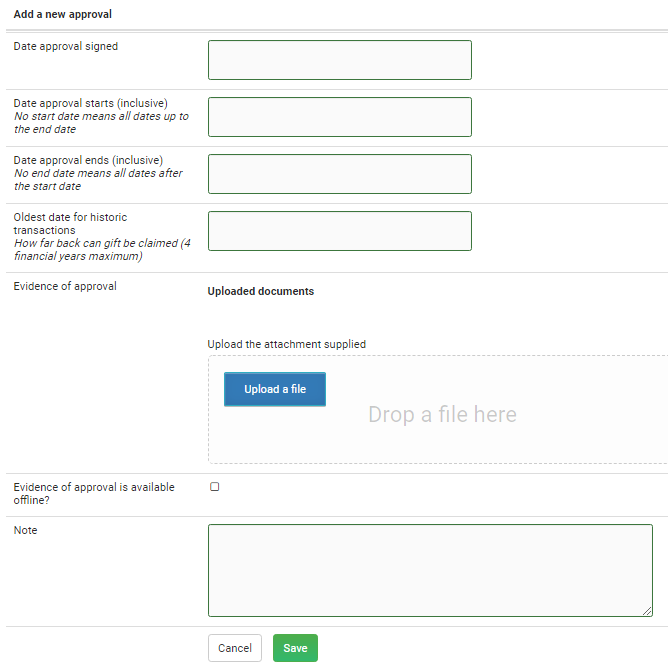

Adding or editing an approval gives a number of options:

Date approval signed: This is the only required field and for your reference only

Date approval started: This is the earliest day infoodle will start using transactions for this donor. If its not supplied then there is no earliest date.

Date approval ends: This is the latest day infoodle will use transactions for this donor. If its not supplied then there is no end date.

Oldest date for historical transactions: Without a value here, infoodle will go back to the earliest available transaction (limited by the date approval started) that is up to four financial years old.

Evidence of approval: If you wish, you can upload a single document (15Mb maximum), or use the evidence and note to describe where this approval is located.

3. Using a form

You can include a Gift Aid approval tick box on a form. Once approved the data will be added to the persons Gift Aid approval as point 2 above.

You can have multiple Gift Aid periods if a person stipulates specific periods where you are allowed and not allowed to claim their Gift Aid.