In infoodle the options for receipts, No Receipt, Combined or One-off, are related to if, or when, a contact should be able to receive a receipt for transactions.

The Tax Rebatable or Non-Tax Rebatable information is something that can be managed for receipts, and this is managed by Account Code and associated transactions and not on a per contact basis.

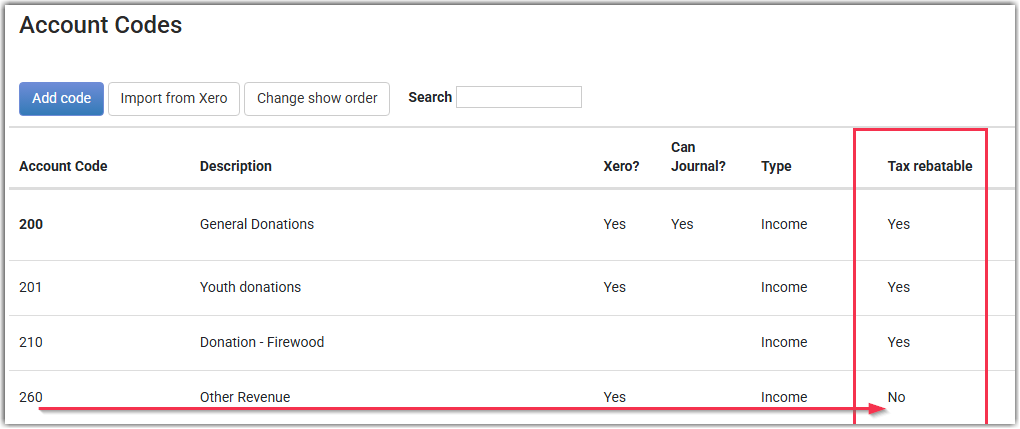

When setting up or managing your account codes in infoodle, each of these can be set as either Tax Rebatable (e.g. Donations) or Non-Tax Rebatable (e.g. fee payments).

There is also a setting for the GST (or VAT) settings for account codes.

When adding or editing account codes, you can set the required Tax Setting for that Account code.

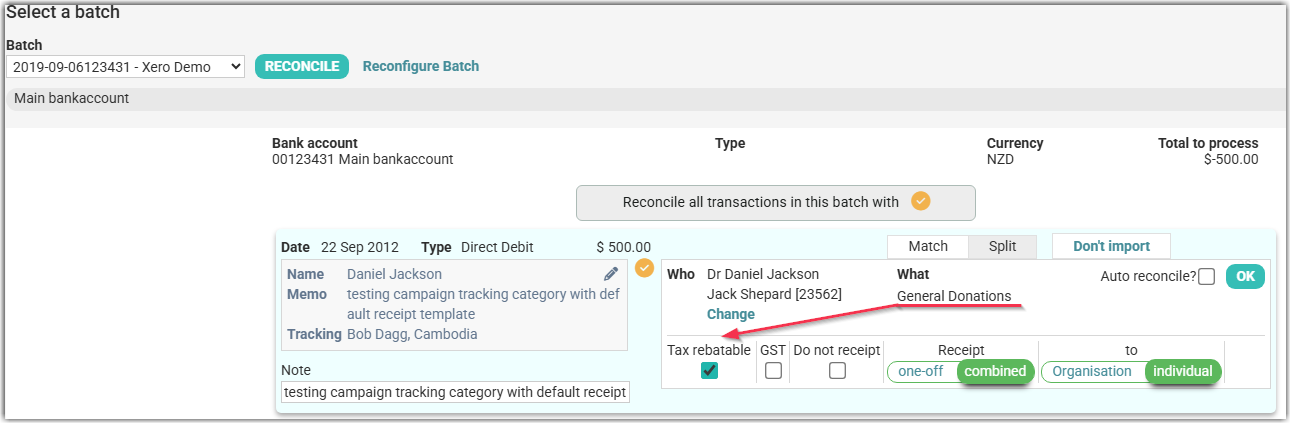

When a transaction is then added to or imported into infoodle, that transaction inherits the Tax or Non-Tax setting based on the account code the transaction is associated with.

In the below example, the "General Donations" account code is set as Tax Rebatable, so the transaction is set to match this when imported from Xero.

When adding, reconciling or editing transactions, a user can change the Tax or Non-Tax setting for any transaction to override the setting it inherits from the account code.

In order to be able to switch the transaction tax rebatable status from the account code default (in the case above, Tax Rebatable), to non-tax rebatable, you need to have an entry in the Account Code table and assign the same account code number for both taxable and non-taxable entries.

NOTE - if you change the tax setting for an account code, this will only be applied to newly added or reconciled transactions after the date/time of the change. Existing reconciled transactions will not automatically update to match a change to the account code tax settings. If needed, the infoodle Tech Team can apply a bulk change to the tax settings for transactions by account code

Generating Receipts

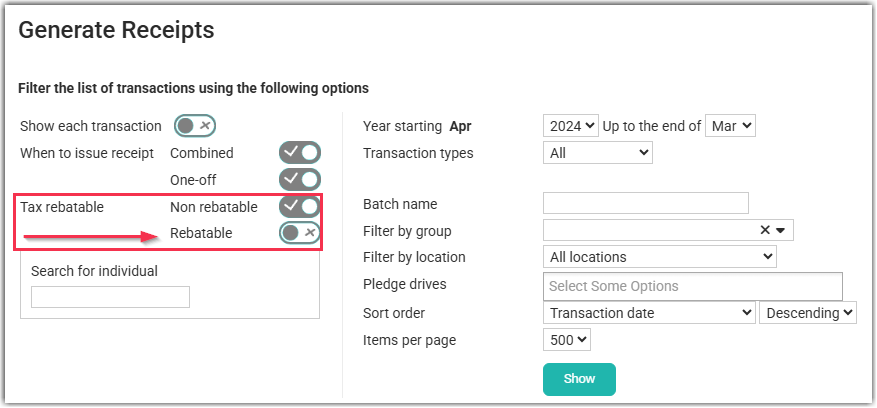

When generating receipts, provided the transaction data is set correctly as a Tax Rebatable or Non-Tax Rebatable amount, there are filters on the Receipts screen to Show or Hide the transactions to be receipted, based on their tax status in the database.

In the below example, the "Rebatable" filter is turned off, so only transactions that are Non-Tax Rebatable are displayed for receipting.

If you want to generate separate receipts for Tax and Non-Tax transactions, you can set the receipt filters to display only one or the other, then receipt using a suitable template.

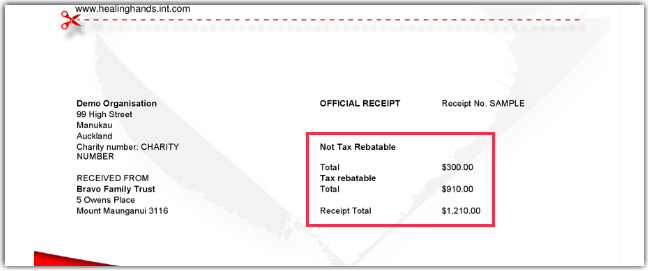

The receipts themselves can also be configured to separate Tax Rebatable and Non-Tax Rebatable transactions with one receipt if both type of transactions are included in a receipt run.

The above example uses the generic {tax receipt} merge field, but there are other receipt fields that can be used to show Tax vs Non-Tax data in the receipt.