Please see Finance terms for some definitions that clear the misconceptions between Receipts and statements.

Before getting started

Before getting started make sure that you have setup the following first:

1. Finance settings

Select on Administration then System then Finance to set these up:

- Tax year starting month - this is the first month of the year that your tax year starts where April is the common month used.

- Details of the organisation issuing the tax receipt - your organisation details.

- Charity number - If you wish to have your charity number included in the receipt, then you can add the number in the Finance settings and add the {charity number} personalisation in the correct place in the receipt or statement template if you wish.

For more information, see Finance Settings

2. Receipt, Statement and email template(s)

- Receipt & Statement templates - In order to generate a receipt or statement you need to create a template first. This tells infoodle where to place the text, images and transaction information on a PDF page.

For more informations, see Adding a receipt or statement template

- Email template - Also if you are going to be emailing a receipt then you also need to setup the email template first.

For more information ont the three things that need to be in place before emailing a receipt, see Emailing a Receipt

3. Transactions entered under Batch Transactions

- These transactions need to be marked as not printed in order to appear on this screen. They are marked as printed once the receipt is generated and you click mark as printed or generated.

4. Prior to generating receipts

- Please ensure your receipt names and totals match (see below for more information).

Check the totals

It is vital that the numbers within infoodle match with your accounting activity. In general you would expect there to be one or more donation lines in your accounts, and this should match up with the totals you are about to receipt. If it doesn't match, there needs to be a good and documented reason why!

Batch Report

For each batch you process in infoodle, we encourage you to print off a full batch report once you are sure the numbers are correct. This enables you to pick up any errors straight away.

For more informations, see Batch Reports

Quick Check

To do a quick check on the totals:

- Click Finance on the Navigation Menu.

- Click Receipts.

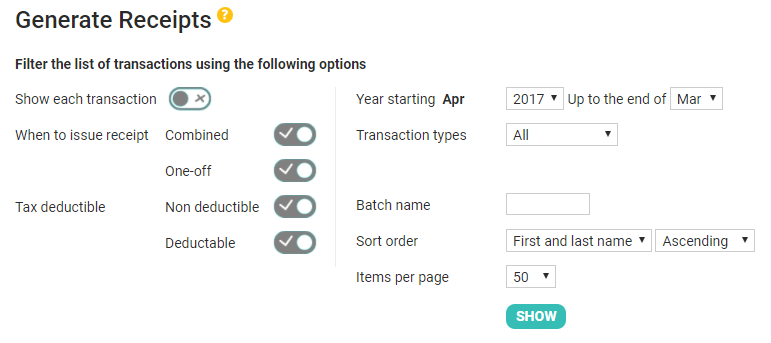

- Ensure that you have the right year selected in the filter, and click SHOW.

- Scroll to the bottom of the page. The total shown there may often be sufficient. NOTE: if there are a large number of transactions that span across more than one page then the total at the bottom of the page will be the total for that page. To see the final total for all pages, go to the last page.

This total will only be sufficient if you are not generating receipts continuously throughout the year ie Generating statements and then generating receipts once during the year at year end. See best practice below.

If you need more detail then you may need to go to the Reports menu and run a Report.

For more information, see People Finance Reports

These totals will only be sufficient if you are NOT receipting continuously throughout the year i.e. You are generating statements during the year and then only generating receipts once a year.

infoodle best practice is to send out statements during the year and generate receipts once a year at year end.

If you are preparing to do year end then see Year End Checklist

When to receipt?

There are a variety of ways that different organisations generate their receipts.

- One receipt run after year end

- On donation receipting

- Periodic receipting

- Mixture of the above

For more informations, see When to Receipt?

Whose name will it generate the receipts under?

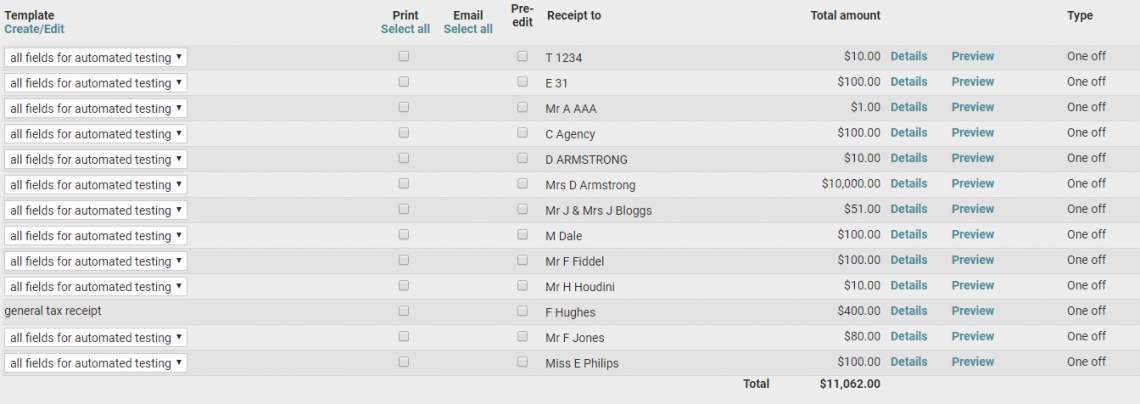

By viewing the list on the Receipts screen(as in the screenshot above), you can see the names that infoodle will use to generate a receipt in the Receipt to column. These names are available using the {receipt to name} personalisation field. This also is used as part of the {receipt} personalisation which generates all the key information required in receipts.

If the names are incorrect, then you need to review the following options and adjust the relevant data so you see the receipt names as required.

Single persons name (e.g. Mr J Smith):

Used for individual donations

- The transaction needs to be set to 'receipt to individual'.

- They need their own giving number or no giving number. If this individual is splitting their giving equally with other people and need their receipt issued separately, then ensure they share the same giving number with the others, but the giving number is set to 'split' rather than 'combine' in the giving number screen.

Couples name (e.g.Mr J & A Smith):

Used for a couples donations who are combining their giving.

- The transaction needs to be 'receipt to individual'.

- The couple either need to have either:

- A single person record for them both, OR

- Have two person records that are allocated the same giving number.

If using two separate records for each person, then to combine the couple for receipting purposes, the Marital Status field needs to be set to the same value in each of their personal records e.g. both set to Married or De facto.

For more informations, see Issuing Joint Receipts

Household / Organisation name (e.g. The Print House Ltd):

Used when an organisation donates rather than the individual's in that organisation.

- The transactions need to be 'receipt to household' or 'receipt to organisation'.

- The household name needs to be set in their address area of their person record.

Alternative Household / Organisation name or Alias (e.g. The Print House Childrens Trust):

Used when an organisation donates, and the household name is used as part of the normal infoodle operations e.g. letters, emails and reports.

- The transactions need to be 'receipt to household' or 'receipt to organisation'.

- The Receipt to Alias needs to be set for their household information.

For more on the rest of the Year End Check, see Year End

If you are ready to start generating receipts, see Generating Receipts