When a transaction is recorded, it is most common for the donor of that transaction to be the focus. This means the transaction appears in the donors financial information on their profile screen and is used to identify the growth in donations and reporting.

There are some organisations who identify that donation with a specific person. An example could be a child sponsorship, or mission agency who is raising funds. In these scenarios the recipient is part of the infoodle database and they need to identify how much income is being received to their project or personal fundraising.

Once this is established you can use the Income Statements function to generate statements for these individuals.

infoodle can recognise income using one of two methods.

a) Campaigns

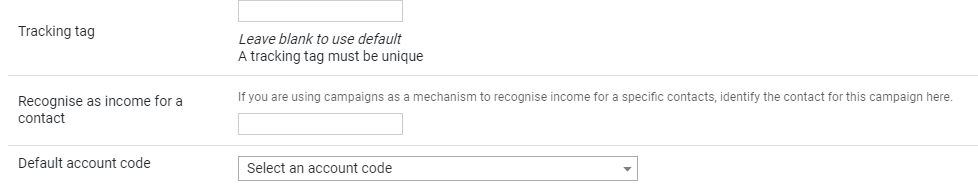

If you do not integrate infoodle with Xero, campaigns can provide an effective method for recognising income. Each relevant campaign can be linked to an individual. This means the campaign reporting can be done for head office for overall reporting requirements, and the person running that project, or the individual doing the fundraising can be made aware of this information.

b) Tracking Category.

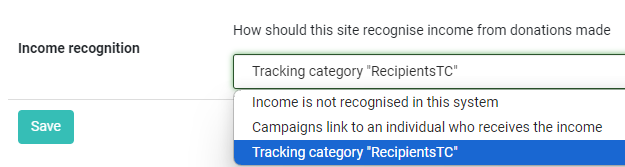

If you use Xero, you are able to connect each item of the tracking category to an individual in infoodle. This means when you reconcile the transaction in Xero you can identify both the donor and the recipient.

To configure infoodle to recognise the income in either of these ways, go to Administration - System - Finance and at the bottom is the setting for recognising income.

When this is set, the options on the Campaign to select the recipient become available.