Setup

When filing to the HRMC there are 2 methods.

- Direct to HMRC

- Manually using HMRC spreadsheet

Manual filing does not require any settings, however if you are filing direct, you firstly need to make sure all of the settings are correct:

Under Gift Aid > Settings > Charitable Organisation, make sure the Submission mode is set to "Live" and save this (if changed).

Make sure that the Settings on the "Charitable Organisation" and "Authorised Official" pages have been filled out. Note that the ID and Password on the Authorised Offical settings will be what you use to log in to HMRC.

Prepare Claim

Then, from the Claims Page:

For the required claim, click the "Action" Button and "Review" to Open the claim.

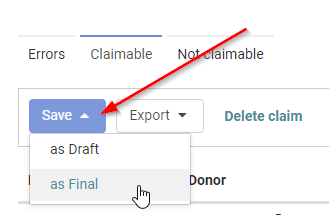

From the screen showing the list of transactions that you have reviewed, click the "Save" button and choose "Save as Final" - this will return you to the Main Claims Screen, and the claim will be listed as Finalised

File the claim

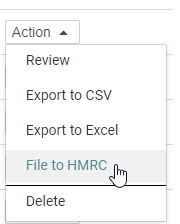

Click the "Action" button again and click "File to HMRC"

From this screen you are presented with the 2 options for filing, direct or manual.

Direct filing - will perform the process of sending and verifying the claim with HMRC. Any errors raised here are from HMRC and will relate to the settings or content.

Manual filing - you can download the file infoodle presents, open the file and copy / paste it into the supplied HMRC document in the location for the transaction data. You are responsible for filing the data to the HMRC when you use this method.

You can still Review claims once submitted if you need to look up details or see the HMRC Response once this is registered for that claim

You can reset a claim after it has been submitted. Click here for more information

Invoice

If you are using Xero, you are able to ask infoodle to create an invoice in your Xero site for the amount you will be receiving from HMRC.